Are You Forgetting to Budget for These 50 Expenses?

THIS POST MAY CONTAIN AFFILIATE LINKS. MEANING I RECEIVE COMMISSIONS FOR PURCHASES MADE THROUGH THOSE LINKS, AT NO COST TO YOU. PLEASE READ MY DISCLOSURE FOR MORE INFO.

Everyone knows that creating a budget allows you the knowledge of knowing where your money goes and the freedom to decide what is most important to you to continue your lifestyle.

But one of the toughest parts of budgeting is making sure you budget everything; there are a few things you may be forgetting to budget.

In this post, I’m going to go over 50+ expenses that are easily forgotten, make sure you are budgeting for these expenses in your budget categories.

Don’t Forget to Budget for These 50 Expenses To Better Manage Your Money

Here are 50+ expenses that you may want to add to your budget. I know 50 different types of expenses may seem like a lot. But keep in mind that the items on this list do not have to be their own separate categories. Just make sure you know where they fall into your budget. If you are having trouble sticking to your budget consider using a tool like YNAB that will help to track your expenses.

How to Budget – The Ultimate Guide

1. Emergency Fund

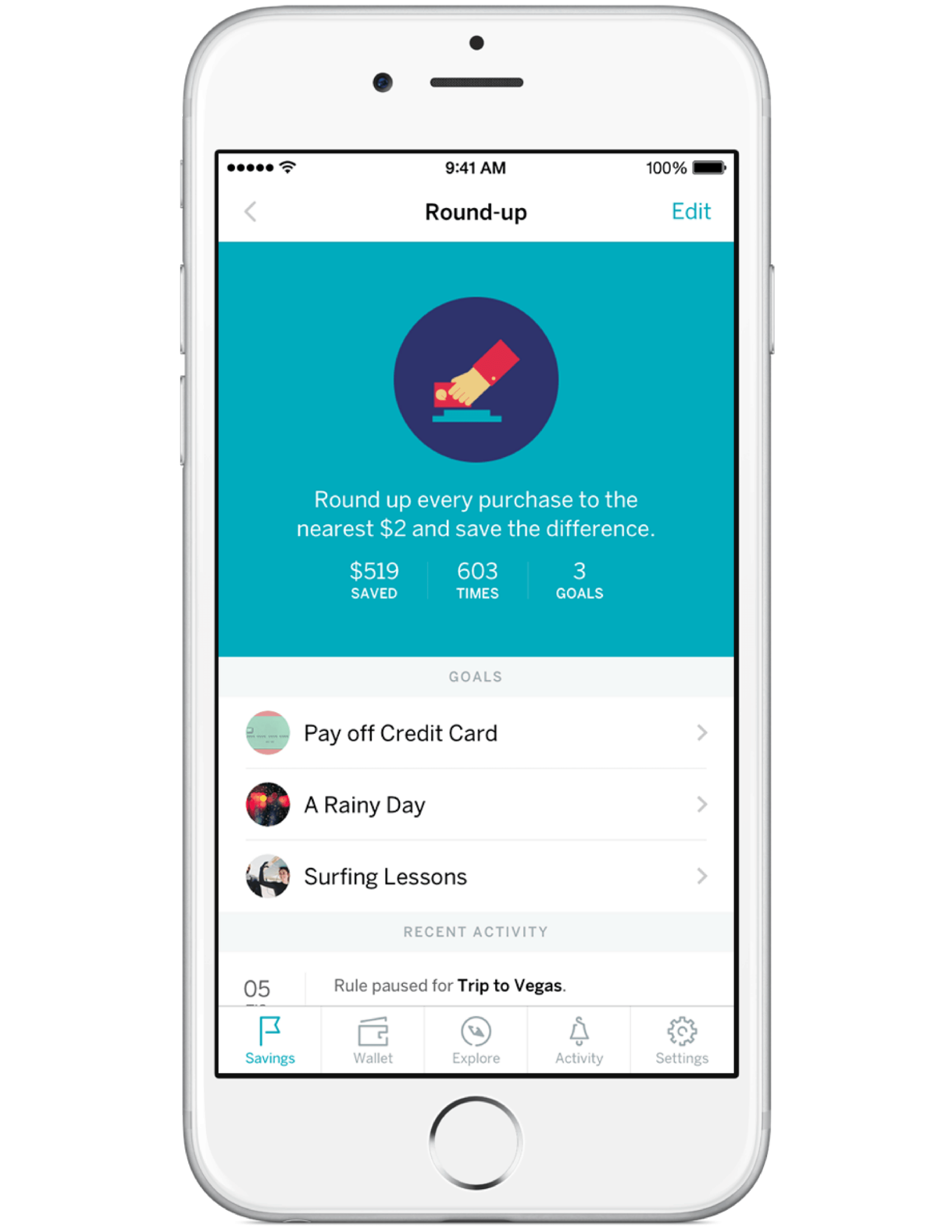

If you don’t have an emergency fund , now is the time to start saving for one! By building savings into your budget, it will be even easier to handle unexpected expenses (or unbudgeted expenses). Related: Digital vs Manual – The Best Way to Build Savings.

If you don't want to open up a new bank account, then Qapital can help you reach savings goals. Once you have the Qapital App installed and a bank account (or in my case three) connected you set up a goal or goals. I currently have two, one to save for taxes #selfemployed and one to save for spending money when I travel hack my way to Paris. Then you set savings rules for each of your goals.

For example, I have a round up to the nearest $2 rule, a guilty spending rule -when I buy Dominos, and a savings rule for every time I hit my step goal with FitBit. There are tons of different savings rules you can set up based on your spending habits.

2. Retirement

Saving for retirement is important. Adding retirement savings to your monthly budget can help you stay accountable.

Remember if you have a tax-deferred retirement account, contributing $100 will not result in taking $100 from your take-home pay. But it will help you when your retire and the cost of living has gone up. Save for retirement now with a small hit to your income, thank yourself later.

Figuring Out Your First Full-Time Job Benefits

3. Extra Debt Payments

If you plan on paying off debt every month, consider it an extra cost that you should put it in your budget! Even if it’s just a few dollars extra, they can add up quickly.

Debt repayment in the form of minimum payments should be a given when it comes to your monthly expenses, but setting aside an extra $20 can save you so much in the long run.

Related: 5 Apps to Help You Pay Off Debt Faster

4. Quarterly Bills

Saving for bills that don’t come up frequently can save you a lot of hassle. This includes anything like a water or gas bill that you may pay every few months or insurance.

5. Rate Increases

Have you ever gotten a utility bill that was higher than you thought? Sometimes rates go up, you likely got a notice about it and promptly forgot.

Adding these possible expenses to your budget can keep you from worrying about how you will pay that overage.

6. Household Maintenance

If you own your own home, you should be prepared for expenses like pest control, roof repairs, or even replacing appliances. A good rule of thumb is to save 1% of your home’s purchase price every year for maintenance.

You should really have a separate emergency fund just for your home.

7. Property Taxes

If you already have property taxes built into your mortgage payments, you may not have to worry about this. But if you pay once a year, you should be setting aside money each month to cover this expense.

8. Home Security

A home security system can help you feel safer in your home, but it can also be a budget sucker! Make sure to add this to your monthly budget if you use a traditional home security system, so you don’t end up surprised when the bill comes.

Though with technology you don’t necessarily need a monthly security subscription.

Only support cloud storage, you can view the last three days of records for free.

9. Home/Renter’s Insurance

Whether you own your home or rent, you may want to invest in home insurance, or you may be required to carry renters insurance. Not only will this protect your precious belongings, but it will also protect you should you need to use it.

10. Yard Maintenance

Just like with inside your home, it’s wise to budget for care outside of your home. Yard maintenance can cover everything from mowing and leaf clean up to snow removal.

11. Home Furnishings

Life happens, maybe you like to redecorate often, or a roommate moved out, or your dog had explosive diarrhea on the couch, either way, you are in need of some new home furnishings.

Having a little set aside for such an event or at least having a plan if such an event were to occur, can help make sure you don’t end up with a financial headache.

12. Cleaning Supplies

Cleaning supply expenses can add up, but you can be prepared for them if you add them to your budget!

This could also include items like laundry detergent.

These items are things you need but don’t need to restock every month necessarily, so just having some set aside when you do, can help. It may be part of your buffer if need be.

13. Medical Co-Pays

Even if your insurance is taken out of your check each time you are paid, it’s important to save for the co-pays you may have to pay if you use your insurance.

You could use an HSA or FSA to pay medical costs, but make sure you’ve set yourself up to contribute to such funds, which have to be built into your budget.

Medical costs can quickly add up, so it’s good to set aside a bit of your monthly income to be prepared.

Related: How I Scored an Extra $150 for my HSA

14. Vision & Dental Expenses

Sometimes vision and dental expenses aren’t covered through your traditional health insurance. If they aren’t, make sure to include them in your monthly budget if you need them.

For example, my dentist offers two cleanings, x-rays, and a discount on any other needed work for around $300 for the year.

15. Medication

Do you take medications regularly? Don’t forget to add them to your budget.

Medication prices can add up quickly and wreck your budget if you aren’t aware of how much they cost. If the cost is creeping up, consider switching to a less expensive pharmacy.

Also keep in mind, medications for others, like your pets.

16. Supplemental Insurance

While not necessary to have, supplemental insurance is great to have in case you get injured or have a baby (in some cases this can be seen as a disability). Budgeting for this may make sense for you.

17. Life Insurance Premiums

Everyone should have life insurance. It may be included as part of your work benefits but if not consider getting some on your own.

It doesn’t have to be expensive, but it is wise to put it in your monthly budget so you don’t forget about it.

18. Car Registration

Even though this expense doesn’t happen often, you can prepare for it ahead of time by putting it in your monthly budget. This is one expense, I am guilty of always forgetting and it’s always more than I expect it will be.

19. Car Insurance

Whether this is part of your monthly expenses or you pay it every few months, car insurance can be something that you forget about it until you need it.

Add it to your budget, so you have the money set aside when it comes time to pay up.

20. Car Maintenance

Even new cars need maintenance. Add up costs like oil changes, tune-ups, and brakes, find the average over the course of a year and add it to your monthly expenses.

21. Public Transportation

If you don’t have your own car, add your public transportation costs to your monthly budget. But transportation costs can sneak up on you so keep track of this expense; you may be able to get a small deduction on your taxes if you are using public transportation to commute to work.

22. Parking Fees

If you live or work in an area that charges parking fees make sure you know how much it is costing you each month and build it into your budget.

23. Toll Fees

Living near tolls can mean paying the fees. Even if you are able to pay a set fee, remember to add them as an expense for your budget.

24. Gym Membership

Love going to the gym? Don’t forget to plan for it! Some gym memberships may not be expensive, but if you plan on spending money on them, you might as well budget for them.

25. Professional Memberships Like Bar Dues

These memberships can be anything from dues for a union, or even dues for a sorority/fraternity. On the other hand bar dues may be covered by your employer, but if you are licensed in more than one state, you may be required to cover the cost of one of your bar dues.

26. Grocery Memberships

Memberships like Costco and Sam’s Club come once a year, so don’t forget to have the money in your budget to renew them when the time comes. No one likes a surprise when reviewing their monthly expenses.

Related: How to Save Money on Groceries

27. Magazine Subscriptions

If you are subscribed to any magazines or newspapers, you can add these to your budget as well.

28. Box Subscriptions

Box subscriptions are fun, but they can add up. Make sure you keep track of all of them and if you are struggling to make ends meet these should probably be on the chopping block.

Related: Are Subscription Boxes Ever Worth It?

29. Clothes

If you are a professional or someone that needs to buy clothes on a regular basis, consider adding the costs to your monthly budget items.

This could also be something to budget if you work out regularly as you may need to replace gym clothes as well.

Related: How I Revamped My Summer Wardrobe for $35

30. Electronics

Electronics aren’t something you may need to buy every month. But because they can be expensive, you may want to have a buffer fund for you to save money for them.

For example, if your iPhone shatters on its way into a toilet.

Alternatively, you may just want to budget insurance for such gadgets.

31. Beauty Expenses

You deserve to take care of yourself, but the costs can add up. Don’t let your beauty supplies wreck your budget. Make sure to include these costs in your budget month to month.

32. Toiletries

Toilet paper, toothpaste, and even soap are necessities in any home, but you’d be surprised at how many people forget to add these to their budgets.

33. School Supplies For Kids

If you have kids, you know how expensive school supplies can be. You can prepare for these expenses ahead of time by budgeting for them year-round, that way the money is there when you need it.

34. Continuing Education Costs Like CLEs

As an attorney, most states require you earn continuing legal education credits. While you may be able to obtain some of these for free through your firm or bar association membership, you may also need to fork out some money to pay for them.

For the non-attorneys, if you are taking college courses, you can always save for items like credits or even the books for your classes.

35. College Costs + Planning

If you plan on paying for college, you’ll need to break down tuition costs. If you want to save for the future, you can invest in an account like a 529 plan.

36. Child Care Back Up

If you have little ones that need to be watched and something happens with your regular scheduled childcare, know the cost of your backup plan and put it somewhere in your budget.

37. Gifts

Don’t forget about birthdays and holidays. Add gift giving to your monthly budget, so these holidays or events like baby showers, weddings, and other similar events, don’t sneak up on you.

Related: Shopping for Gifts When You’re in Debt

38. Travel Expenses

If you have any trips coming up, planning for the expenses like the cost of bag check, transportation to and from the airport and visa costs.

Setting aside money ahead of time can save you money and a headache.

39. Pet Expenses

Pets can save you money, but they can also be expensive. Last-minute trips to the vet are no fun for you or your fur baby, but they can be even less fun for your finances. It’s still important to save for them just in case.

Related: How Having Pets Can Save You Money

40. Wedding Expenses

You may think that if you aren’t getting married this won’t apply to you. However, if you are between the ages of 25-35 chances are you are invited to at least one wedding a year if not more.

Save up for gifts, travel, and if you may be in the wedding, the cost of the dress/tux and the events associated.

41. Entertainment Expenses

If you like going out, don’t forget to add entertainment expenses to your budget and stick to the budget you give yourself. I’m not talking about Hulu or Netflix, but rather the less regular concert ticket or baseball game, or theater ticket.

42. Delivery Fees

If you’d rather order in instead of going out a majority of the time, don’t forget to tip your delivery man or woman and factor in the delivery fee that gets tacked onto the bill.

43. Party Supplies

Even if you plan parties on occasion, you can still prep your budget for them. This would be another great option for a buffer fund which can help pay for forgotten items and unexpected expenses without dipping into your emergency fund.

44. Donations

Giving may be important to you, or perhaps you just like to support your 5 friends running races for charity. So long as you save a spot in your budget for those donations, you’re golden.

Related: How to Manage Debt and Still Donate to Charities

45. Fundraisers

Many fundraisers require a minimum donation. Don’t forget to budget for these expenses if you attend fundraisers regularly.

46. Business Development

If you are self-employed or looking to advance your career, you may want to invest in courses or classes to help you grow your business and skill set. Don’t forget to add these costs to your personal (and business) budget.

47. Office Supplies

Office supplies are fun to buy when you’re a nerd like me. However, the less fun expenses like when I need to buy ink is almost always a surprise. Which is why I keep a small amount budgeted to cover those expenses.

48. Dry Cleaning

Most of the time you may be able to get by with at home options like Dryel , but every once in a while you need some professional dry cleaning, make sure you’ve got an easy $20 set aside to cover those rare occasions.

49. Moving Expenses

We all know the struggles of moving.

If you are planning to move either to a new apartment or to buy a house, remember that a down payment is not the only cost you need to save for, moving costs too.

Sometimes, finding a budget for moving expenses can be challenging, but it’s not impossible.

Whether you hire movers or rent a U-Haul, you’ll need money for these things. Make sure you’re creating a line in your budget for moving.

50. Vacation Fund

Sure you may be planning on going on a vacation, but have you actually set aside money to pay for it?

In order to save up for a vacation, one should plan it out and set up a budget. The first step is to decide where you want to go and what you would like to do there. This is the most fun part of the planning process, but time-consuming. Once you have decided on your destination, create a budget and estimate how much money will be needed for this vacation. Add in gas prices, food costs, airfare costs, and accommodation costs. Remember that these are just estimates; don’t expect them to be accurate!

Once you have calculated the total cost of your vacation in advance, take out an amount from your bank account each week that will cover the price of your trip without leaving behind any debts or bad credit from over drafting or maxing out your credit

51. Student Loan Payments

If you’ve graduated recently then your student loans are likely in a grace period. But once that grace period ends, you’ll need to start making your payments. Best to start budgeting for those payments as soon as possible.

Wrapping it Up with a Bow on Top

So there are 50 expenses you may be forgetting to budget. While these won’t apply to everyone, they are worth thinking about and adding to your budget if they make sense for you.

Keep in mind if you don’t want a ton of categories in your budget because 50 categories would be overwhelming, you can combine them into other categories.

Have you forgotten to budget for these expenses? What are some things you’ve forgotten to budget? Let me know in the comments!

I do really well remembering all of these things for budgeting…not so well estimating realistic numbers!

I found myself consistently under-budgeting by 5-10%, so I now have another budget line item: “Unforeseeable Expenses”. Unforeseeable Expenses is a catch-all category equal to 10% of my non-savings expenses. No matter which budget categories I underestimate, I’m covered!

That’s really smart! I do something similar with a buffer line in my budget.