How to Budget Successfully Every Time – The Ultimate Guide

THIS POST MAY CONTAIN AFFILIATE LINKS. MEANING I RECEIVE COMMISSIONS FOR PURCHASES MADE THROUGH THOSE LINKS, AT NO COST TO YOU. PLEASE READ MY DISCLOSURE FOR MORE INFO.

Budgeting can be clutch to taking control of your money but can be a bit overwhelming when starting out. I’m going to break it down for you by first explaining what a budget is, hint, it’s not a way to torture yourself.

Then we are going to cover the three basic rules of a successful budget. We’ll walk through step by step how to budget successfully and finish up with different budgeting tools available that may be helpful for you.

What Is A Budget?

If you are going to learn how to budget, it helps to know what is a budget. By definition, a budget is an estimate of income and expenditures for a set period of time. Notice there is nothing in the definition about depriving yourself of things that are important to you.

The only time it might feel like a budget is depriving you of what you want is if you have a habit of living beyond your means, i.e., spending more than you make. In which case, yes the adjustment to living within your means may not be the most fun and at times may feel like you are depriving yourself. But it is all a matter of perspective and attitude.

Even if it does lead to a little deprivation, it will give you back so much more. A budget is going to help you figure out where all your money is disappearing to and start focusing on your financial priorities.

It is going to help you achieve your financial goals, get out the paycheck to paycheck cycle, be prepared for emergencies, and basically set you on a path to becoming a personal finance boss, yup all you have to do is learn how to budget.

The 3 Premises of Budgeting

There are a few basic rules when it comes to successful budgeting and they have been mentioned over and over again on personal finance blogs and websites everywhere.

Except I noticed when I was first learning how to budget that they were mentioned but not always explained. So today I’m going to explain just what all these budget basic rules mean when applied to your finances.

1. Spend Less Than You Earn

This seems pretty basic, but it is the first step to successful budgeting and success in your finances in general. A lot of times when people first start learning how to budget, they start assigning amounts to different categories, based on their expenses. Then they add it all up and realize the budgeted amount is more than their income, there in lies the problem and the cause of their financial woes.

Start with knowing exactly how much you make.

Down to the penny. What actually gets put in your bank account? After taxes, deductions for health insurance, retirement and anything else. Start assigning amounts to the absolutely essential expenses you know you will incur (housing, food, transportation).

After each amount subtract it from your income. Once you hit zero, stop. You can’t afford anything else. Hopefully, this will cover all of the essentials and the only thing you’re giving up are things considered non-essentials aka “wants”.

If your income doesn’t cover your essentials

You need to start cutting back on those expenses, is there a cheaper apartment you can move into, or can you refinance your mortgage for a lower payment each month? Can you walk to places instead of using gas driving? Are you using coupons to shop for food, is there a cheaper grocery store you can go to?

Alternatively or in addition to cutting back, you can hustle to make more money. Get a second job on the weekends, or look for one-off gigs on sites like craigslist. Sell stuff you don’t use anymore. Do anything you can (anything legal) to bring in some extra income. Keep cutting back and hustling until your expenses are no longer greater than your income.

Related: 45+ Ways to Save Money and Still Have a Life

2. Pay Yourself First

Every time I would see this, I’d be like what are they talking about? The money goes into MY account, aren’t I paying myself first already? No.

What this really means is pay your goals first.

You are obviously going to budget out the amount you need for the essentials, but you are hopefully also budgeting what you need to accomplish whatever financial goal you have. It could be to save an emergency fund or paying off your credit card.

Whatever your goal is, make it the first thing you do with your money. Know how much you are going to put towards it and once the deposit hits, make that payment, before you pay the rest of your bills, before you do anything else. That money goes straight towards that, pay your goal first.

The flip side of pay yourself first is pay yourself last. What a lot of people do and what I’ve been guilty of in the past is committing to put all of my “extra money”/ what’s left over after paying all my bills towards that goal.

The thing is, other expenses would always pop up and cut into that “extra money” amount and I would never end up putting enough money towards my goal to accomplish it in time. If you wait to pay yourself last, you won’t be paying yourself nearly as much. Make yourself a priority and pay yourself first.

3. Pay A Month Ahead/ Have a Buffer

If you are just learning to budget, a likely motivation to do so is that you are living paycheck to paycheck and want to get out of that vicious cycle. You see the rule that you need to budget a month ahead and probably think that if you could do that you wouldn’t be in this position in the first place. The thing to remember is that this can mean a few different things depending on how you like to handle your money.

Some take this to mean that all of the money they spend in January, they made in December and all the money they make in January is to be spent in February so that they are always a month ahead.

If anything happens they aren’t screwed because they are ahead of the paycheck to paycheck cycle. I’ll be honest, I don’t do this, not entirely anyway. I pay all my bills a month ahead, so I paid all of my January bills with my December income.

However, my everyday spending is from the current month I’m in, so my grocery shopping money for January is from January. I feel comfortable doing this because, I also have an emergency fund that will pad the blow, should anything happen. My emergency fund ensures I don’t slip back into the paycheck to paycheck cycle.

If you don’t have an emergency fund. I highly recommend you make building an emergency fund a priority. If you can’t imagine finding extra money to set aside for an emergency there is are tools and accounts that will do it for you. Chime is just one great option. Qapital is another great option.

If you don’t want to open up a new bank account, then Qapital can help you reach savings goals. Once you have the Qapital App installed and a bank account (or in my case three) connected you set up a goal or goals. I currently have two, one to save for taxes #selfemployed and one to save for spending money when I travel hack my way to Paris. Then you set savings rules for each of your goals.

For example, I have a round up to the nearest $2 rule, a guilty spending rule -when I buy Dominos, and a savings rule for every time I hit my step goal with FitBit. There are tons of different savings rules you can set up to make saving easy. Bonus, when you use my link you’ll get $5 after your first savings.

How to Budget

It doesn’t matter what budgeting tool you use, whether it is a good ole fashioned spreadsheet, YNAB, or some other tool. In order to build a successful budget that you will actually stick to, you will have to go through each of the following steps. Now the order in which you go through them may vary, but this is the order that I recommend. Here is how to budget:

Step 1: Evaluate 1-3 months of expenses and categorize each transaction

By taking a look at how you spend your money you are more likely to set yourself up for success. You may find you are spending way more in a category than you thought. So in building a budget that will work for you, you have to take that into account.

The closer you can get to using your actual numbers, the more realistic you can be when setting your budget. If you are consistent, and you track your money throughout your budgeting you’ll be able to see not only how far you’ve come, but you’ll be able to make better spending decisions.

[Tweet “If you are consistent, and you track your money you’ll be able to see not only how far you’ve come, but you’ll be able to make better spending decisions.”]

Tracking Your Money is Clutch

Tracking your money is key to successful budgeting. Just looking at your income and then budgeting it isn’t going to work unless you have an idea about how much you actually spend in each category.

Lots of people “budget” their paycheck. The ones that have successful budgets are tracking their spending to ensure they stay on budget throughout the month. They don’t just wait until three days before the next payday to realize they are out of money and then wonder where it went.

Budgeting without tracking is like showing up to the 5k expecting to finish in 30 minutes without ever having practiced running a mile. If you don’t know how long it takes you to run a mile, how can you know if you can finish in 30 minutes?

If you don’t know how much you are spending in reality on groceries or going out, how can you budget for it? Successful budgeting starts by examining your spending habits. Then little by little adjusting them so that you are practicing what you want your budget actually to be.

Step 2: Using that data, determine your anticipated spending for each category

Total up how much you spent by category and divide by the number of months you used to pull the information. You should now be able to see an average of how much you will likely spend in each category were you to not do anything. If some of the totals surprise you, these are probably areas that you can cut back in.

Step 3: Determine your expected income

You can’t know how to budget unless you know what you are budgeting. If you are a salaried employee this should be easy, just take a look at your paystub.

However, if your income varies, try taking the average of the last 3 months of income and using it as a guideline. If you really want to play it safe, you could just use the lowest amount of income you’ve made in the last 3-6 months.

Now compare your expected income to your anticipated spending. Is there a difference? Is your income more or less than your anticipated spending?

Step 4: If your anticipated expenses exceed your expected income, evaluate what areas in which you are willing to cut back. Or how much more money you will need to make

I know math is probably not your thing, but do it anyway, I’ll even let you use a calculator. Figure out exactly how much the discrepancy is and how you will make up for it. Will it be easier to cut some spending or to pick up a second part-time job?

Remember that there is a limit on how much you can cut back. But there is no limit on how much you can earn. Get a second part-time job, start freelance writing, start a blog, pick up a craigslist gig, the possibilities are endless. You can always do something to make more money.

Step 5: Take action on cutting back or making more

Make those phone calls to cancel subscriptions, or get rid of things that are causing you to spend more. Start selling your junk for extra cash, or apply for another job to help bring in that extra income. Do what you got to do to meet the numbers you set out in Step 4.

Step 6: Set a realistic budget. Incorporate where you will cut back and where you will apply the extra money you will make

You should have a list of categories from Step 1. Now take that list and budget an amount for each category. How much you budget for each category should be somewhere between your actual past number and where you’d like to be. Remember, to take baby steps, it will help to keep you motivated to stick to your budget.

Step 7: Track your expenses to make sure you are sticking to your budget and know when to stop spending

It does you no good to create a budget and then do nothing. You will spend more if you don’t actually pay attention to what you have budgeted for each category. Also, remember that you can change your budget from month to month. It is not something set it stone or a set it and forget it type of document. It is one that will require regular reviews and revisions.

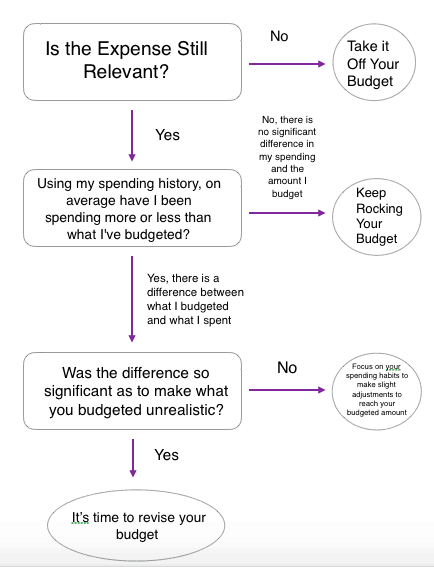

You can use this handy chart I made to help you determine what should stay part of your budget and what needs revising.

Budgeting Methods & Tools

I’ve found that I stick to my budget best by writing it down on paper. However, I’ve tried different budgeting tools and methods and have found them to be helpful in finding weaknesses in my budget. Self-tracking is the most basic and customizable.

It can be great to learn how to budget using Mint.com and YNAB as they are online tools with some preset categories and great blogs. If spreadsheets aren’t your thing YNAB and Mint could be great alternatives. Lastly, there is the envelope method and my twist on it for the debit card loving folks.

Self-Tracking Budgeting

How to budget utilizing the Self-Tracking method will require you to open up a blank spreadsheet. Or check to see if the spreadsheet software you use has a budgeting template (Mac Numbers has a budgeting template). Then follow the usual steps for budgeting.

Pull together at minimum a month’s worth of statements. For a more accurate picture of your spending habits try to pull together 3-6 months of statements. Add a column for each new expense and put the date of the expense going down the side. Then totaled the columns for the month to determine how much you spend in each category.

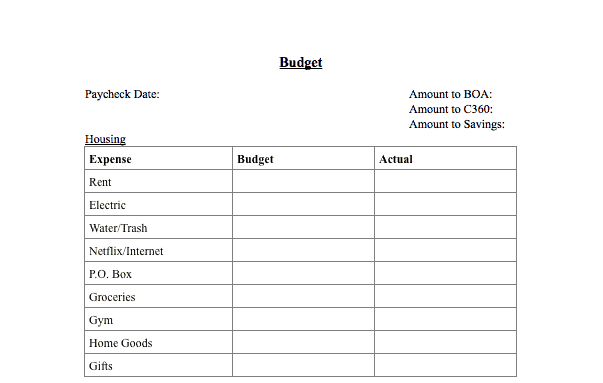

Use the totals as a baseline of what you will likely spend in each category. Continue with Steps 2-7. If you don’t want to be working in a spreadsheet each month. Consider using that first spreadsheet as a resource to create a budgeting template you print out, like the one I have below.

YNAB (You Need A Budget)

Unlike Mint, YNAB is not free but it is super affordable at just $5 a month or $50 for the year. YNAB operates under 4 rules. Rule one-give every dollar a job. Rule 2. Save for a Rainy Day. Rule 3. Roll with the Punches. Rule 4. Live on Last Months Income.

Honestly, when I first started, Rule One was a game changer for me. It continues to be the first thing I do when I get paid, whether I’m budgeting with YNAB or on paper.

Rule Two is also great and is key to being prepared for emergencies. However, Rule three is where I struggled with using YNAB. It is almost too easy to change your budget on a whim in YNAB and take away from savings for a bigger bill down the road. For that reason, I continued to have trouble with saving for big bills and moved to paper.

Rule 4 I think is a matter of interpretation. Since I pay next month’s bills with my current month’s income, I’m technically there. Except, I still need the current month’s income for my everyday expenses such as gas and groceries.

If you are interested in trying out YNAB, they do allow you to use it on a trial basis (for free) for 34 days. Another great thing about YNAB that really helped me when I was just starting to learn how to budget was their free webinars to help you get started. Definitely, take the time to check it out.

Envelope Method

So while each of these budgeting tools and methods are great and do work. However, some people like a more hands-on approach to budgeting. Enter the how to budget with cash only, envelope method.

It is simple enough, you mark an envelope for each category and using cash only, put the amount budgeted into the envelope. Once the envelope is empty you are done spending for that category. It is most helpful for those that find swiping their credit card just too easy.

The problem with the all cash envelope system for me was that I very much rely on making payments online. Enter my idea to use monopoly money to represent what I had in the bank. Years ago in my pack rat days (I live much more minimally now) I picked up the board game at a garage sale, after digging it out, I started playing the part of the banker.

I have a salaried position with a small variable compensation plan. So while my income does vary month to month, there is a set amount I’m guaranteed (so long as I keep and do well at my job) to make each month. Accordingly, I carefully counted out the monopoly money equivalents for my two paychecks.

How I got started with the envelope method – using Monopoly money

Different bills are due at different times of the month and I live two paychecks ahead. So while the income of each of my salaried paychecks is the same, the outflow differs. Looking at a calendar listing all of my bills and their due dates I started labeling envelopes with the bill name and amount due.

For bills that varied, I wrote the average amount. I then assigned each envelope to a paycheck. From there I divided up the monopoly money into the envelopes allowing $200 every two paychecks to cover gas and groceries. Anything left over went into the envelope of the debt I focused on paying off first.

It turned out that everything except for my rent, gas, and groceries- I made payments for online. As such I resigned myself to a cash-only budget for gas and groceries and my regular check for my rent. Thus, my monopoly money budget was born. I could, of course, use the $200 on eating out and any other “fun stuff” but I always need to make sure I have enough for gas each week too so every two weeks I spend that $200 a little different.

As you probably noticed my monopoly money budget incorporated many lessons learned from those other budgeting ideas and tools. So mixing and matching can be great for budgeting.

Related: How to Make Cash Envelopes

3 Most Common Budgeting Mistakes & How to Avoid Them

Hooray! You know how to budget and you’ve set your first budget, now what? Avoid the mistakes I made when I first started budgeting. Here are the three biggest budgeting mistakes and how you can avoid them.

1. Having a Set it and Forget it Budget

The Mistake: Budgets are not crockpots, you can’t just set them and forget them. Writing out your budget is great but it does little to actually help you take action on that budget.

How to Avoid It: In order to actually stay on budget you have to keep track of your spending throughout the month. Sit down and input your spending to see where you are with your budget. It may be that you do this throughout the day as you spend or at the end of each day or the end each week. Though any further out and you are likely to lose track of how much you spend and how close you are to going over budget.

2. Letting One Thing Throw Off Your Entire Budget and Giving Up on Budgeting

The Mistake: You planned and tracked and set up the perfect budget. Then life happened and life isn’t perfect, it comes up and knocks your pretty little budget right on its ass. It’s a parking ticket, a medical crisis, a broken appliance and now you’re pulling extra funds from anywhere you can. Try as you might you still end up over budget. Why did you bother budgeting in the first place? Budgeting just seems impossible, screw it, I’m done, at least for this month. I’ll try again later.

Sound familiar?

How to Avoid it: Incorporate a buffer into your budget to cover things you forgot to budget or small unexpected expenses. Also, build up an emergency fund to help cover those big unexpected expenses.

$1k is a good place to start with an emergency fund. By the way, a credit card is not an emergency fund. I talk more about how to build an emergency fund and a buffer in this post.

3. Not Continually Adjusting Your Budget

The Mistake: Change is part of life, we already discussed how you can’t just set and forget your budget once created for the month, but you also you shouldn’t have the exact same budget each month. You will have various irregular bills throughout the year, birthdays and holiday gifts from time to time and weather will affect your utility bills.

How to Avoid it: In addition to tracking your spending throughout the month, at the end of the month look at the big picture and evaluate how you did overall. Make adjustments and cuts where necessary. On top of that, check your calendar to see what extra expenses you may have coming up.

These could be insurance bills, upcoming events (birthdays, anniversaries, holidays), trips or nights out (concerts, plays etc). Then start budgeting for them. Keep in mind you can set aside a little each month towards these expenses. You don’t have to wait until the month of to add it into the budget.

Wrapping it Up with a Bow on Top

That was a lot of information I know, but you can always download the guide to reference it as you work through budgeting. Remember while this guide will help you budget successfully, chances are you can’t complete all of these steps overnight. It will take some time. Be kind to yourself as you work your way through building your successful budget.