What is Student Loan Forgiveness and How to Qualify?

THIS POST MAY CONTAIN AFFILIATE LINKS. MEANING I RECEIVE COMMISSIONS FOR PURCHASES MADE THROUGH THOSE LINKS, AT NO COST TO YOU. PLEASE READ MY DISCLOSURE FOR MORE INFO.

Wouldn’t we all love a pardon on our student loans? Depending on your loans and/or what you do for a living, you just might qualify for student loan forgiveness after a certain period.

Before you get too excited, realize that depending on the program you qualify for, that forgiven amount might actually become one big ole tax burden. So What is student loan forgiveness?

What is Student Loan Forgiveness?

Student loan forgiveness and qualification varies greatly. There are several federal income-driven repayment plans that include student loan forgiveness. There is also public service loan forgiveness, and some states even offer different programs to help with student loan repayment. Who doesn’t love free money?

At the end of the day, Student Loan Forgiveness means not having to repay some amount of your student loans. Though depending on the amount borrowed, the repayment plan, and the taxable amount, you might not end up with as much being forgiven as you’d hoped.

I’ll Still End Up Paying over $200k

In my case, if I do nothing and stick to my income-based repayment plan with 25 years worth of payments and the taxes I’ll pay at the end, I’ll end up paying well over $200k. When I graduated in 2011, I had borrowed a total of $193k. So at the end of the day, I’ll have paid back more than I borrowed and ultimately paid nearly as much as I would have on a standard repayment plan. All while being in debt for 25 years.

Now, I’m not against paying back the same amount as I would have under standard repayment, however, under standard repayment my loans would only be bothersome for a decade. Instead, I will end up paying that much after 2.5 decades and a crippling tax bill. Ultimately this stunts my ability to save for retirement and other financial goals.

Different Types of Loan Forgiveness

As I mentioned before, there are lots of different student loan forgiveness programs. Income-driven repayment plans for federal loans are the most well known. However, there are also state-sponsored programs.

Income-Driven Repayment Plans and Student Loan Forgiveness

There are several different income-driven repayment plans for your federal student loans, including Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), REPAYE, and PAYE. Which repayment plan you qualify for depends on the types of loans, what they were borrowed for (graduate vs. undergraduate study) and when you borrowed the loans.

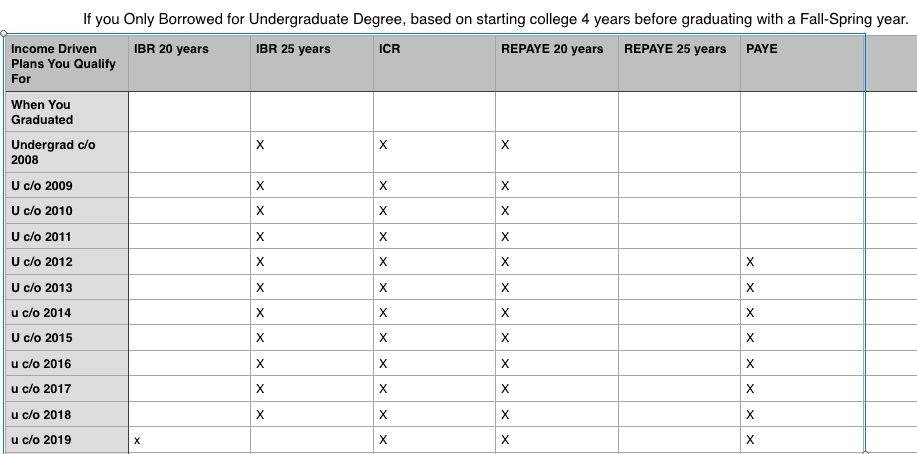

Here is a quick view of what income-driven plans you qualify for based on when you graduated.

Undergrad:

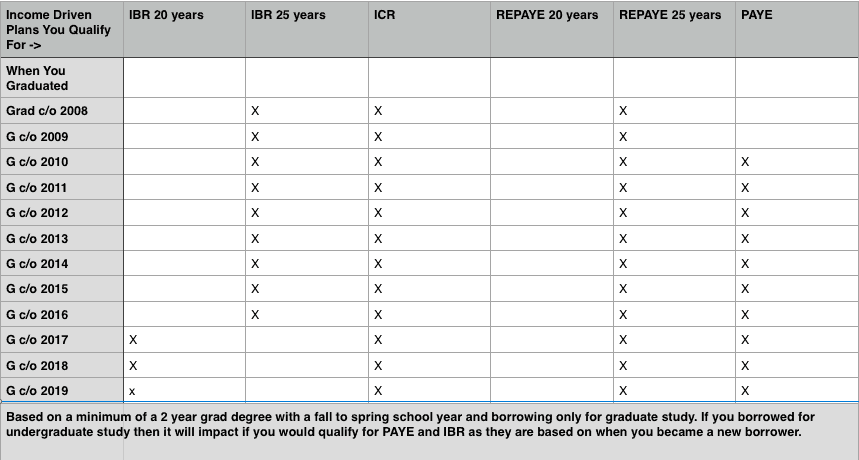

Graduate:

Here is a more detailed view of the income-driven repayment plans:

Income-Based Repayment (IBR)

What it is:

Depending on when you borrowed you make payments of 10-15% of your discretionary income for 20-25 years.

If You Are a New Borrower AFTER July 1, 2014

You will make payments for 20 years, and your payments are capped at 10% of your discretionary income so long as 10% doesn’t exceed the amount you would pay under the standard repayment plan. After 20 years your remaining balance is forgiven.

If You Borrowed BEFORE July 1, 2014

You will make payments for 25 years, and your payments are capped at 15% of your discretionary income so long as the 10% doesn’t exceed the amount you would pay under the standard repayment plan. After 25 years your remaining balance is forgiven.

How to Qualify

To qualify for IBR, the payment you would make under IBR must not exceed what your payment would be under a standard repayment plan.

Any Surprises?

YES! The forgiven amount is taxable income. For example, if you end up with $30,000 left at the end of 20/25 years, you will be taxed as though you made an additional $30k. Meaning, if you usually make $35k per year, you will be taxed as though you made $65k that year. This would nearly double what you would normally owe in taxes.

Income-Contingent Repayment Plan and Student Loan Forgiveness

What it is:

If you have qualifying loans, you will pay up to 20% of your discretionary income or what you would pay if you had a fixed repayment plan over 12 years adjusted according to your income for 25 years.

What Loans Qualify?

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- As well as Direct PLUS Loans made to Graduate or Professional Students

- Direct Consolidation Loans IF they did not repay PLUS loans made to parents

- Direct Consolidation Loans that did repay PLUS loans made to parents

Do Consolidated Loans Qualify?

The following loans qualify if they are part of a consolidation loan:

- Subsidized Federal Stafford Loans

- Unsubsidized Federal Stafford Loans

- FFEL PLUS Loans made to Graduate or Professional Students

- FFEL PLUS Loans made to Parents

- As well asFFEL Consolidation loans that did NOT repay PLUS Loans Made to Parents

- FFEL Consolidation Loans that repaid PLUS Loans made to Parents

- Federal Perkins Loans

How to Qualify

So long as you have qualifying loans, you will qualify for this repayment plan.

Any Surprises?

YES! The same surprise as with IBR, the forgiven amount is considered taxable income.

REPAYE and Student Loan Forgiveness

What it is:

You will pay 10% of your discretionary income for 20-25 years depending on whether you borrowed for graduate or undergraduate study.

If you borrowed exclusively for undergraduate study:

You will make payments of 10% of your discretionary income for 20 years so long as your loans qualify.

If any of your loans were borrowed for graduate study:

You will make payments of 10% of your discretionary income for 25 years so long as your loans qualify. Note that even if some of your loans were for undergraduate study since you have a loan that was for graduate study you will be required to make payments for 25 years.

What Loans Qualify?

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- As well as Direct PLUS Loans made to Graduate or Professional Students

- Direct Consolidation Loans IF they did NOT repay PLUS loans made to parents

The following loans qualify if they are part of a consolidation loan:

- Subsidized Federal Stafford Loans

- Unsubsidized Federal Stafford Loans

- FFEL PLUS Loans made to Graduate or Professional Students

- FFEL Consolidations Loans that did NOT repay PLUS Loans made to Parents

- Federal Perkins Loans

Any Surprises?

Yes, the forgiven amount is considered taxable income.

PAYE and Student Loan Forgiveness

What it is:

You will make payments of 10% of your discretionary income for 20 years.

How to Qualify:

To qualify you must:

- Have a payment (10% of your discretionary income) that does not exceed what the payment would be on a standard repayment plan; AND

- Be a new borrower as of Oct. 1, 2007; AND

- Recieve disbursement of a Direct Loan on or after Oct. 1, 2011.

You qualify if you didn’t start college until Jan. 2008 or later and continued your studies past Oct. 2011. If you graduated early, no PAYE for you.

Any Surprises?

Yes, the forgiven amount is considered taxable income.

Public Service Student Loan Forgiveness

In my opinion, public service loan forgiveness (PSLF) is the dream, mainly because the forgiven amount is not considered taxable. However, it is very strict in who qualifies for PSLF.

What is it:

A forgiveness program available to those working in public service, examples include positions working for the government or a non-profit organization. You qualify for forgiveness after making 120 qualifying payments. Unlike other student loan forgiveness programs, the forgiven amount is NOT considered taxable income.

How to Qualify:

Only Direct Loans qualify for PSLF. Additionally, you need to work full-time for a qualifying employer. While you must make 120 qualifying payments, they do not have to be 120 payments in a row, so if you change employers and somewhere in the middle work for a private organization, you could still qualify.

Lastly, loan forgiveness is NOT automatic after making 120 qualifying payments. You must actually submit a PSLF application which will be available before Oct. 2017. Why? Since the program only became available in 2007, the first people to qualify would at the earliest qualify in Oct. 2017.

Any Surprises?

Yes, unfortunately, there is no guarantee of how long the PSLF program will be available. You may start working towards PSLF now, but Congress could decide in 5 years to discontinue the program.

If you want to know more about PSLF you can check out their FAQ.

State-Sponsored Forgiveness or Assistance Programs

Every state is different in what they offer regarding student loan forgiveness or assistance programs. Many of the programs are based on the field in which you work. If you are wondering what might be available in your state, The College Investor has done a great job gathering all of the state-specific programs into one place.

Lastly, Your School May Provide Some Type of Loan Repayment Assistance

I’ll admit I’ve only seen this available to law school graduates, but some law schools have come up with loan repayment programs to help their recent graduates. Equal Justice has gathered a list of schools with Loan Repayment Assitance Programs.

A Few Other Things to Note

- Nothing is set in stone. What repayment plans are available may expand or change. For example, both presidential candidates have proposed new options to be available to borrowers.

- Nothing is set in stone part two. You can change your repayment plan once a year; you don’t have to pick one and stick to it for the entirety of your loan.

- Definition of a New Borrower: “Someone who has no outstanding balance on a Direct Loan or Federal Family Education Loan (FFEL) Program loan when he or she receives a Direct Loan or FFEL Program loan on or after a specific date.”

- Definition of Discretionary Income:”For Income-Based Repayment, Pay As You Earn, and loan rehabilitation, discretionary income is the difference between your income and 150 percent of the poverty guideline for your family size and state of residence. For Income-Contingent Repayment, discretionary income is the difference between your income and 100 percent of the poverty guideline for your family size and state of residence.”

Any questions? Let me know in the comments!

Recommended Refinancing Company:

If you have private loans or your debt to income ratio allows, consider refinancing with a company like SoFi. Learn more about what it’s like to refinance with Sofi. Refinancing my bar loan with SoFi ended up saving me over $1,000. Use my link to refinance your student loan and you’ll get a $100 bonus.

Student loan forgiveness is great -although the tax could be substantial you would be rid of the big loan payments every month. Great tips and advice.

Thanks, there is actually a lot happening in this area, it’ll be interesting to see how the election results could impact current borrowers.

Oh wow, that is a really detailed post! Love what you are doing over here 🙂 I’m in the UK so our student loan debt payment is a completely different kettle of fish!

Thanks! Obviously this is all US based, I have no clue what is happening with student loans in the UK. Appreciate you stopping by 🙂