The Best No Credit Check Credit Cards for Building Credit

THIS POST MAY CONTAIN AFFILIATE LINKS. MEANING I RECEIVE COMMISSIONS FOR PURCHASES MADE THROUGH THOSE LINKS, AT NO COST TO YOU. PLEASE READ MY DISCLOSURE FOR MORE INFO.

If you’re looking for a way to build your credit history, no credit check credit cards may be the right solution for you.

These cards allow you to open a secured credit card without a hard inquiry on your credit report, so you can start building your credit score without any damage.

These cards are considered credit builder cards. However, it’s important to remember that no credit check cards can come with high-interest rates and fees, so make sure you can afford to pay off your balance each month.

What are no credit check credit cards and how do they work

No credit check credit cards are credit builder cards that do not require a hard inquiry on your credit report in order to be approved.

This means that you can get approved for the card without any negative impact on your credit score. These cards are designed for people who are looking to build their credit history or are rebuilding credit to improve their credit score.

Besides having no hard inquiry on your credit they differ from traditional credit cards, in that no credit check cards are secured credit cards. Meaning your credit limit is linked to your security deposit.

How can no credit check credit cards help you build your credit history

Your credit score is determined by the following 5 factors:

- Credit Length (how long have you had credit for)

- Payment History (do you make payments on time)

- Mix of Accounts (how many different credit types do you have? Credit cards, student loans, mortgage etc.)

- Hard inquiries (are you trying to open a bunch of new lines of credit at once?)

- Credit Utilization (do you carry a balance on your unsecured cards? how much access to credit do you have)

Payment history accounts for 35% of your score and refers to if you make payments on time. Credit utilization is the next biggest factor accounting for 30% of your score and refers to your credit balance. For example, if you have a credit limit of $1,000 and your current balance is $500, you’re utilizing 50% of your credit.

Learn more about what impacts your credit score here.

No credit check credit cards can help you build your credit history by giving you the opportunity to borrow money and make payments on time. By making on-time payments, you can improve your payment history, which is one of the most important factors in your credit score.

Additionally, using a no-credit check credit card can help you build up your credit limit, which can also positively impact your credit score.

What are the benefits of using a no credit check credit card

There are several benefits of using a no credit check credit card:

1. You can get approved for the card without any negative impact on your credit score.

2. These cards can help you build your credit history by giving you the opportunity to borrow money and make payments on time.

3. Using a no credit check credit card can help you build up your credit limit, which can also positively impact your credit score.

While there are many benefits to using a no-credit check credit card, they only work if you use the card responsibly. Irresponsible use will show on your credit report from the major credit bureaus and negatively impact your score.

Things to watch out for when using a no credit check card

No credit check cards come with some risks that you should be aware of before using one:

1. These cards can have high interest rates and fees, so it’s important to make sure you can afford to pay off your balance each month.

2. No credit check cards can only help you build your credit history if you use them responsibly to build good credit habits. This means making on-time payments and keeping your balance low.

3. If you decide to cancel your no credit check card, make sure you do so in a way that won’t damage your credit score.

No credit check cards can be a great way to build your credit history, but it’s important to use them responsibly. Make sure you can afford to pay off your balance each month and only use the card for purchases that you can afford. If you do, you’ll be on your way to a great credit score in no time!

How to choose the best no credit check card for your needs

There are a few things you should consider when choosing a no-credit check card:

1. Interest rate and fees: As these cards are typically secured credit cards, the two things to look out for are the annual fee, and the interest rate if you don’t pay your balance off in full each month.

2. Credit limit: Choose a no-credit check card with a credit limit that you can comfortably pay off each month.

3. Rewards: Some no credit check cards offer rewards programs, so if this is important to you, look for a card that offers points or cash back on your purchases.

4. Card issuer: Make sure you choose a no credit check card from a reputable issuer such as Visa or Mastercard.

5. Customer service: When you have questions or problems with your card, you want to be able to reach customer service easily. Make sure the issuer you choose offers 24/7 customer support.

6. Easy card management: Look for a card that makes managing your account easy. For example, some cards allow you to set spending limits and alerts, while others let you track your spending online.

No credit check cards can be a great way to build credit, as long as you are using them properly By choosing the right card and using it wisely, you can establish a good credit history that will benefit you in the long run.

The Best No Credit Check Credit Cards

There are a lot of options when it comes to no credit check cards, we’ve pulled together a list of the best ones to help you find the right card for you.

All of these cards report to all three major credit bureaus making sure your efforts to build your credit work.

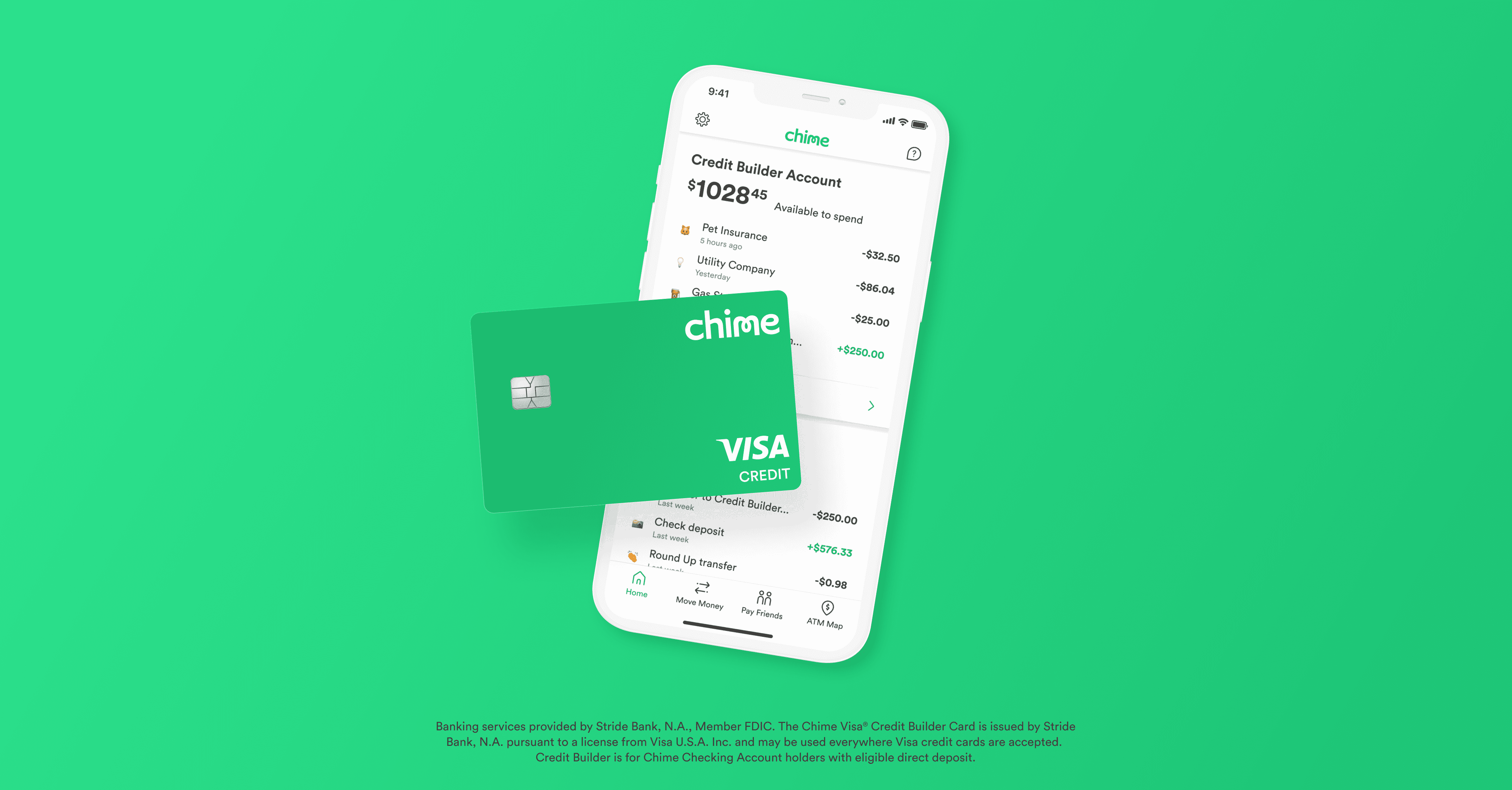

Chime Credit Builder Card

The Chime Credit Builder Card has no fees and a 0% interest rate on purchases, however, it is only available to Chime members (those with an online banking checking account) who have a qualifying direct deposit into their account. You can read more about the card here, but the basics are:

Credit Check: none, which means no credit inquiry will show on your credit report

Required Security Deposit: there is no minimum security deposit required

Fees: none, no annual fee, no late payment fee, no foreign transaction fees

APR: 0% interest on purchases

Additional Features: To help you build your credit, they offer “Safer Credit Building” which will make automatic payments using the funds in your Credit Builder secured account. Ensuring you always have on-time payments. In this way, it can feel a bit like a prepaid card, but unlike prepaid cards, it reports to the credit bureaus.

Complete an Online Application here.

- No annual fee or interest

- No credit check to apply

- No minimum security deposit required

Must be a Chime member before you can qualify for a credit-builder account.

OpenSky Secured Visa Credit Card

With a low annual fee and reporting to all of the major credit bureaus, it makes for a great credit builder card for those that aren’t eligible for the Chime Credit Builder Card. Here are the basics:

Credit Check: none, which means no credit inquiry will show on your credit report

Required Security Deposit: $200 minimum security deposit required

Fees: $35 annual fee, up to $38 late payment fee, 3% foreign transaction fee, other fees as well

APR: Varies but at the time of writing was 18.14%

Additional Features: The OpenSky Visa has an 85% average approval rate and comes with all the benefits of a Visa card. The security deposit acts as collateral for your card, but it may feel like an additional deposit since it will only be used to pay down the balance when closing the account.

Complete an Online Application here

A secured credit card that doesn't require any credit check. Perfect for those looking to build their credit.

Annual Fee: $35

Pros:

- No credit check to apply

- Reports to all three major credit bureaus monthly

- All the benefits of a Visa

The Bottom Line

If you’re looking for a no credit check card to use to build credit, then there are plenty out there. However, not all of them are created equal. There are many factors to consider when selecting a credit builder card including:

1. Fees (annual fee, foreign transaction fee, late payment fee) and minimum deposit required

2. APR (annual percentage rate)

3. Rewards program

4. Customer Service

5. Card Issuer

6. Card Management

We hope our guide helps you find the best no-credit check credit card for you.

FAQs about no credit check cards

Do you still have questions about no credit check cards? We’ve answered the most common questions below.

Can you get a credit card without checking your credit?

Yes, you can get a credit card without checking your credit. These cards are sometimes called “secured” or no credit check credit cards.

What is the difference between a secured card and an unsecured card?

A secured credit card requires a deposit, which is used as collateral if you default on your payments. An unsecured credit card does not require a deposit.

What are the benefits of getting a credit card without checking your credit?

There are several benefits to getting a credit card without checking your credit. These cards can help you build or rebuild your credit, and they can also provide you with a way to improve your financial management skills. Additionally, these cards can help you establish a credit history if you don’t have one.

What are the drawbacks of getting a credit card without checking your credit?

The main drawback of getting a credit card without checking your credit is that you may be subject to higher interest rates and fees. Additionally, you may only be able to qualify for a limited credit line. These cards also tend to have lower credit limits than traditional credit cards.

How can I boost my credit score without getting a credit card?

If you don’t want to get a credit card, there are a few things you can do to help boost your credit score without getting a credit card.

You can start by paying your bills on time and maintaining a good payment history.

Additionally, you can try to reduce your debt-to-income ratio by paying down your debts.

You can also improve your credit mix by adding a variety of different types of credit to your credit history. Finally, you can try to avoid opening too many new credit accounts in a short period of time.

What builds credit the fastest

There is no definitive answer to this question. However, some activities that can help you build your credit include paying your bills on time, maintaining a good payment history, reducing your debt-to-income ratio, and improving your credit mix.

What is the best way to use a credit card to build credit?

Always make your monthly payments on time and avoid using your entire credit line to keep your credit utilization low.

How can I raise my credit score 200 points in 30 days

There is no hard and fast answer to this question. Your credit length and payment history will only improve with time. However, if you can significantly lower your credit utilization in 30 days you could see a big jump in your credit score.

What is your starting credit score when you turn 18

Your credit score is dependent on your financial history, not on your age. In fact, you can start establishing credit with the help of parents or guardians as a teenager.

Is chime a credit card?

Chime’s credit builder credit card is a secured card but a credit card all the same.

Credit cards for poor credit

There are a few credit cards that are designed for people with poor credit. These cards typically have higher interest rates and fees than traditional credit cards. Additionally, they may have lower credit limits and offer fewer perks and rewards. However, these cards can help you build or rebuild your credit if used responsibly.

The no-credit check credit cards mentioned in this article are great cards for those with poor credit and looking to improve their credit score.

Who offers secured credit cards to help build your credit

There are a few different financial institutions that offer secured credit cards to help people build their credit. Some examples include Chime, Capital Bank, American Express, and Citi.

These cards typically require a minimum deposit that serves as your credit line. The deposit is usually a refundable security deposit that you get back when you close your card account. Additionally, they may have higher interest rates and fees than traditional credit cards. However, they can be a helpful tool for building your credit if used responsibly.

Do all credit card types build credit

Yes, so long as you are using the credit card responsibly. If you aren’t making on-time monthly payments or carrying a balance then using the credit card can negatively impact your credit.

How fast do credit cards build credit

Credit cards can help you build your credit if used responsibly. Generally speaking, the longer you have a card and the more responsibly you use it, the more it will help your credit.

What is a good credit score

A good credit score is generally considered to be anything above 700. A score of 800 or higher is considered to be excellent.

What is the best credit card to start building credit score

Some good options for starter credit cards include the Chime Credit Builder Card, the Open Sky Secured Visa, the Discover it Secured Card, the Capital One Platinum Credit Card, and the Citi Secured Mastercard.

These cards typically have lower credit limits and higher interest rates than traditional credit cards. However, they can be a helpful tool for building your credit if used responsibly.

What is the best way to build credit

There are a few different ways to build your credit. You can start by paying your bills on time and maintaining a good payment history. Additionally, you can try to use your credit card responsibly by keeping your balances low and using a low credit utilization ratio.

Does paying your credit card off every month build credit

Yes, paying your credit card off in full every month can help you build your credit. This is because it shows that you are using your credit responsibly and are not carrying a balance from month to month. Additionally, paying your bills on time and maintaining a good payment history can also help you build your credit.

What are some tips for building credit

There are a few different ways to build your credit.

- You can start by paying your bills on time and maintaining a good payment history.

- Additionally, you can try to use your credit card responsibly by keeping your balances low and using a low credit utilization ratio.

- You can also consider getting a secured credit card or becoming an authorized user on someone else’s credit card.

Is it better to have no credit or bad credit

Having no credit can sometimes be just as difficult as having bad credit. This is because lenders often consider people with no credit to be high-risk borrowers. Therefore, it can be difficult to qualify for loans or credit cards. Additionally, people with no credit may also have a higher interest rate when they are approved for a loan or credit card.

Bad credit can make it difficult to qualify for loans or credit cards and can result in high-interest rates. However, bad credit is not impossible to overcome.

There are a few different things you can do to start rebuilding credit, such as paying your bills on time, maintaining a good payment history, and paying down your debt to lower your credit utilization.

Additionally, you can try to avoid opening too many new credit accounts in a short period of time.